When you find yourself seeking a house, there’s an unquestionable interest in going the newest framework channel. As to the reasons move into somebody else’s dated area once you can work that have a builder to help make your dream household? You get new everything you using the modern facts and have in all probability a lot fewer repairs will cost you also.

The fresh new build home may seem like a straightforward option, however they do have the downsides. For starters, mortgages for new structure property were more tricky than simply its resale competitors. You may be plus vulnerable to losing sufferer in order to predatory financing strategies from builders in the process. Listed here are fifteen ways to probably the most common concerns in the the newest build belongings.

step 1. What’s a different sort of design home?

Let us start by the basics: A unique framework residence is one possessions who has maybe not already been occupied because try oriented. While you are to buy regarding a creator, your brand new construction house most likely started out given that a simple parcel of land. Someday, a passionate-eyed designer arrived, ordered brand new property, and you can split up it into buildable tons. They then offered the home in order to a builder whom spent time and money to create properties on each package that will be sold so you can homeowners getting income.

dos. Are there different types of the fresh new construction belongings?

In most cases, you will find step three style of brand new structure house: individualized, semi-individualized, and you will spec. A custom-built home affords you more imaginative command over the brand new type of the new house. Actually, you can work on an architect to have your say more each and every outline-down seriously to just how your doorways move. If you enjoy to go away a few of the decisions in order to the professionals, you are able to opt for a semi-custom-built home, which is an excellent pre-designed assets that you could change to meet your preferences. In the end, if you like just to not contemplate it whatsoever, you are able to decide to transfer to a specification domestic, that is a shift-inside the in a position home, built aside on categories of has actually designed to attract almost any person.

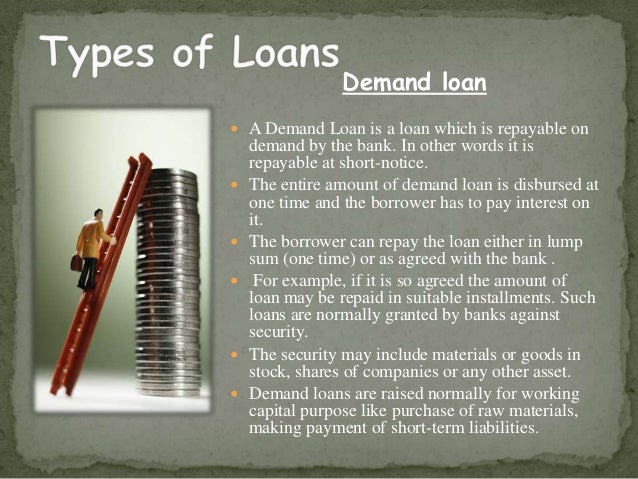

step three. What is the difference in a casing financing and a loan getting a separate framework?

It is tricky, but there is a definite difference in a construction loan and you can that loan having an alternative build. A houses mortgage is employed so you’re able to actually fund this building regarding property. Like, if you desired to purchase the raw materials to build your house, you might take-out a casing financing to aid service their requests. Home financing having a different build occurs when you obtain currency for the true purpose of to invest in a property out-of a builder.

cuatro. How does the loan software techniques differ to own a special construction domestic?

Capital an alternative framework home is maybe not unlike funding a resale house. The most significant differences is within the closure schedule. A loan provider do not intimate into the an alternative design home loan up to the property is prepared on exactly how to https://paydayloanalabama.com/eva/ move around in. This means that you must big date the job on the builder’s plan carefully and guarantee that they never work on past an acceptable limit past the estimated deadline. Such as, imagine if you start your property loan application, rating pre-acknowledged, and you can lock the rates a month prior to build is supposed to be over. Next, your own creator experience allow points and you may all of a sudden construction are put off by ninety days. You may be today at risk of losing their rate-secure window since your bank is unable to intimate in your financing. Be assured, the Mortgage Experts can offer suggestions about local plumber in order to start your application. They are going to account for a range of situations, like the current stage regarding framework additionally the speed off structure up until that point.