Content

If your total number of tax to the season claimed to your Setting 945 is actually lower than $dos,five-hundred, you’lso are not essential and make places within the year. Basically, the brand new put regulations to possess nonpayroll obligations are exactly the same while the talked about second, but the guidelines affect a yearly rather than a great quarterly come back several months. Don’t mix places to have Models 941 (or Form 943 or Form 944) and Form 945 tax debts. You possibly can make a cost having a fast filed Mode 941, Mode 943, Mode 944, or Function 945 unlike depositing, as opposed to running into a penalty, if an individual of your after the is applicable. Learn how to Deposit, after within this part, to own details about electronic deposit standards.

Step-by-Action Self-help guide to Web based casinos inside 2026

You could pay a young detachment penalty or a restriction D punishment for individuals who withdraw money from your bank account before name is done. The minimum starting deposit are susceptible to alter, while the found on the wellsfargo.com/savings-cds/rates. Special interest Speed Dvds require a good $5,100 minimum beginning deposit unless of course if you don’t noted.

Percentage actions

- 15-A will bring more information on earnings, in addition to nonqualified deferred payment, and other compensation.

- Separate accounting when dumps aren’t made or withheld fees aren’t paid off.

- 15-A for factual statements about withholding for the retirement benefits (and withdrawals of taxation-recommended old age agreements), annuities, and you can individual retirement preparations (IRAs).

- Underwithheld taxation and additional Medicare Income tax should be retrieved out of the fresh employee to the otherwise until the history day of the new diary year.

- Understand the Standard Guidelines to have Models W-2 and W-3 for more information.

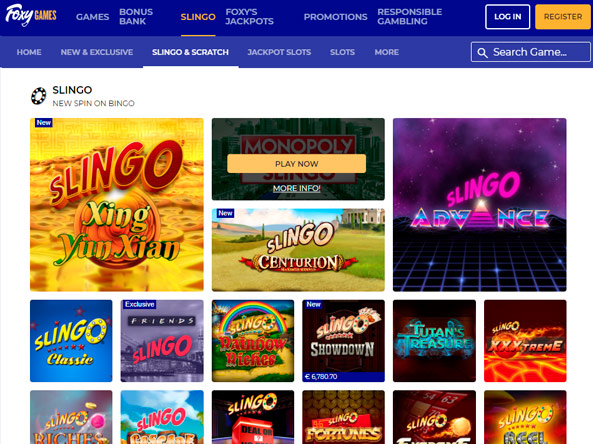

Of numerous networks as well as element specialty games for example bingo, keno, and abrasion cards. Here are the most typical questions players ask when selecting and you may to play during the online casinos. By using these shelter resources, you can enjoy casinos on the internet with confidence and you will comfort. Look out for indicators such put off money, unreactive customer support, otherwise uncertain incentive terms. Merely play during the subscribed and you may managed online casinos to quit cons and deceptive websites.

The amount try put into its wages entirely to possess calculating government tax withholding. Basically, an employee can get claim exclusion away from federal income tax withholding because the they had zero income tax liability this past year and you will predict none this season. Inside the Step 3, staff disappear its withholding from the reporting the brand new annual quantity of one credit they will claim on the tax get back. If a member of staff get regular wages and you may account tips, profile taxation withholding because if the guidelines was extra wages. Withhold tax to the information of wages gained from the worker otherwise from other finance the fresh staff presents (find Federal taxation withholding for the information inside section six).

You wear’t need to make a formal variety of repayment dates or notify the fresh Internal revenue service of the dates you decide on. go right here When nonexempt edge professionals is treated while the repaid. There are more unique laws your group can use in order to worth specific fringe professionals. In general, the amount you must is ‘s the count in which the brand new FMV of one’s work for is more than the sum what the brand new employee purchased it as well as people number legislation excludes.

- The huge benefits try subject to tax withholding and you may a job fees.

- FUTA income tax doesn’t apply to companies inside the Western Samoa, Guam, and the CNMI, but it does connect with companies on the USVI and you will Puerto Rico.

- A reporting agent isn’t accountable as the either a manager otherwise a realtor of the boss on the company’s a career taxes.

- Noncash earnings managed while the dollars earnings try susceptible to personal shelter income tax, Medicare tax, and government income tax withholding.

- They use SSL encoding to protect your own and you can monetary guidance throughout the transactions.

Getting Fans incentive wagers constantly concerns completing specific actions, such registering an account, confirming your own name, or choosing directly into particular campaigns. Including, for many who lay a good $50 Fans bonus bet in the +200 chance and victory, you’ll receive $one hundred in the winnings, but not the newest $fifty risk. If the extra wager wins, you retain the fresh profit — but not the original risk. Fanatics extra wagers is marketing and advertising credit that provide your a go to place a bet without the need for your currency. Because the Fanatics’ preferred (and often provided) type of promo, it can be good for know much more about Enthusiasts incentive wagers to simply help maximum your really worth from them.

Should your FUTA taxation liability for the calendar quarter is actually $500 otherwise reduced, you don’t need put the newest income tax. To own put motives, shape FUTA taxation every quarter. In some says, the wages susceptible to county jobless taxation are identical while the the wages susceptible to FUTA tax. The credit could be up to 5.4% from FUTA taxable wages. Fundamentally, you might bring a cards up against their FUTA taxation for amounts you paid to your condition jobless financing. Thus, in the event the (a) otherwise (b) applies, the newest farmworkers are staff of your own crew leader.

In the first issue the newest team talks about Reed Richards’ rocketship traveling on the superstars. The great Four is made just after four civil astronauts is opened to help you cosmic radiation throughout the an not authorized space sample airline within the an experimental skyrocket vessel created by Dr. Reed Richards. A good spinoff label Surprise Knights cuatro (April 2004 – August 2006) is authored by Roberto Aguirre-Sacasa and very first illustrated from the Steve McNiven within his very first Wonder works.

Join acquire powerful understanding to your team, stock-exchange and community manner.

For those who have overpaid A lot more Medicare Tax, you might’t file a claim to have reimburse for the amount of the new overpayment unless extent wasn’t actually withheld from the employee’s wages (which would become an administrative mistake). The reason being the brand new employee spends the total amount revealed on the Form W-dos otherwise, if the appropriate, Setting W-2c, as the a cards whenever filing the income tax go back (Form 1040, an such like.). In the a recent twelve months, right prior-quarter taxation withholding problems by simply making the brand new correction on the Form 941-X after you discover mistake. Tend to be while the a negative changes to the Function 941, range 9 (or Function 944, line 6), the total uncollected employee share of the social defense and you will Medicare taxes.

If the a manager is utilizing a revealing representative to perform their tax responsibilities, the newest workplace stays liable for the employment financial obligation, as well as liability to possess a career fees. If the an employer is utilizing a great PSP to perform its income tax commitments, the newest employer remains responsible for its a career income tax financial obligation, as well as accountability to own work taxes. Allow me to share well-known third-group payers which a manager could possibly get offer which have to perform payroll and you can associated income tax responsibilities. For many who didn’t report a job fees to have home personnel for the Variations 941, Form 943, otherwise Mode 944, report FUTA income tax for those team to your Plan H (Function 1040). For more information on spending your own taxes which have a card or debit card otherwise playing with EFW, visit Irs.gov/Shell out.

Foreign individuals managed while the American companies. 517, Personal Protection or any other Suggestions for People in the brand new Clergy and you may Religious Pros. You can get more information and you will a summary of agreement places regarding the SSA in the SSA.gov/around the world. See Compensation paid to H-2A visa owners within the section 5. To own information about third-party payers out of ill pay, see Club.