It is common training one to institutional loan providers around the The usa have substantially tightened its being qualified standards. Yet not, most people don’t realize that even when conventional finance are extremely more and more strict, authorities funds haven’t done the same old change. The united states authorities has usually was able a favorite role within the the fresh housing marketplace. On entire savings poor, now more than before, the us government is attempting to meet its mandate to strengthen the available choices of safe and reasonable property for everybody Americans.

Regarding government-backed financing points, this new FHA and you will Virtual assistant loan apps is the quintessential widely used, not, they are certainly not really the only regulators loan applications available. FedHome Mortgage Facilities specializes in resource a myriad of regulators loan and offer software. Our very own Government Loan Professionals usually keep pace up until now along with of the numerous authorities programs and maintain attention to changes and improvements once they is actually released. Will overlooked, however, frequently required from the united states ‘s the USDA Guaranteed Loan. This new USDA rural home loan try a new system that is maybe not supplied by the lenders. It is special since it is the sole zero-deposit system however available to Western people http://speedycashloan.net/loans/no-income-loans in addition to the Va loan.

What is actually a beneficial USDA Home loan?

The USDA Financial , just like the Virtual assistant loan program starts with President Franklin D. Roosevelt. In 1935, thru Manager Purchase 7027 developed the Resettlement Government, whoever objective was to move around in destitute families, impacted by the Depression, heal areas experiencing big ground erosion, and you will let producers which have fund to have equipment and you will belongings. In 1946, the fresh Resettlement Administration try immersed to your Farm Safeguards Management and later on new Farmers Family Government in the 1946. The fresh FmHA is actually registered by congress inside 1946 to incorporate resource having casing, business, and you will people organization in rural areas.

Now the united states Department regarding Agriculture keeps on this new heritage left behind by the FmHA, insuring home loans to own services in the outlying components. The fresh USDA keeps that loan collection regarding $86 mil, administering almost $sixteen mil during the loan guarantees, system loans and you may gives.

An excellent USDA outlying advancement mortgage is actually a guaranteed home loan funded by the a prescription USDA bank less than a professional mortgage system given by Us Institution away from Farming. The fresh new program’s name is the USDA Rural Innovation Secured Property Mortgage system. What is actually one among an informed features of a beneficial USDA loan is their no cash off, 100 percent investment solution. So it software Make certain will come setting the us Government and you may covers the lender in case there is a purchaser standard. Because of their make sure, loan providers whom render these finance are able to forgive the fresh down-commission needed for a home loan. Brand new qualifying criteria for an excellent USDA Mortgage are like an enthusiastic FHA loan as they are much easier and you may flexible than just old-fashioned mortgage software.

Like FHA and you may Va finance, lenders issuing new USDA mortgage is actually secure in the event of a foreclosure by the government. In case there is a default, the government often take-in the majority of losing as an alternative compared to lender. This bodies intervention helps to take back money, create housing less expensive to own lower to average income consumers and you will enhances the full housing also have.

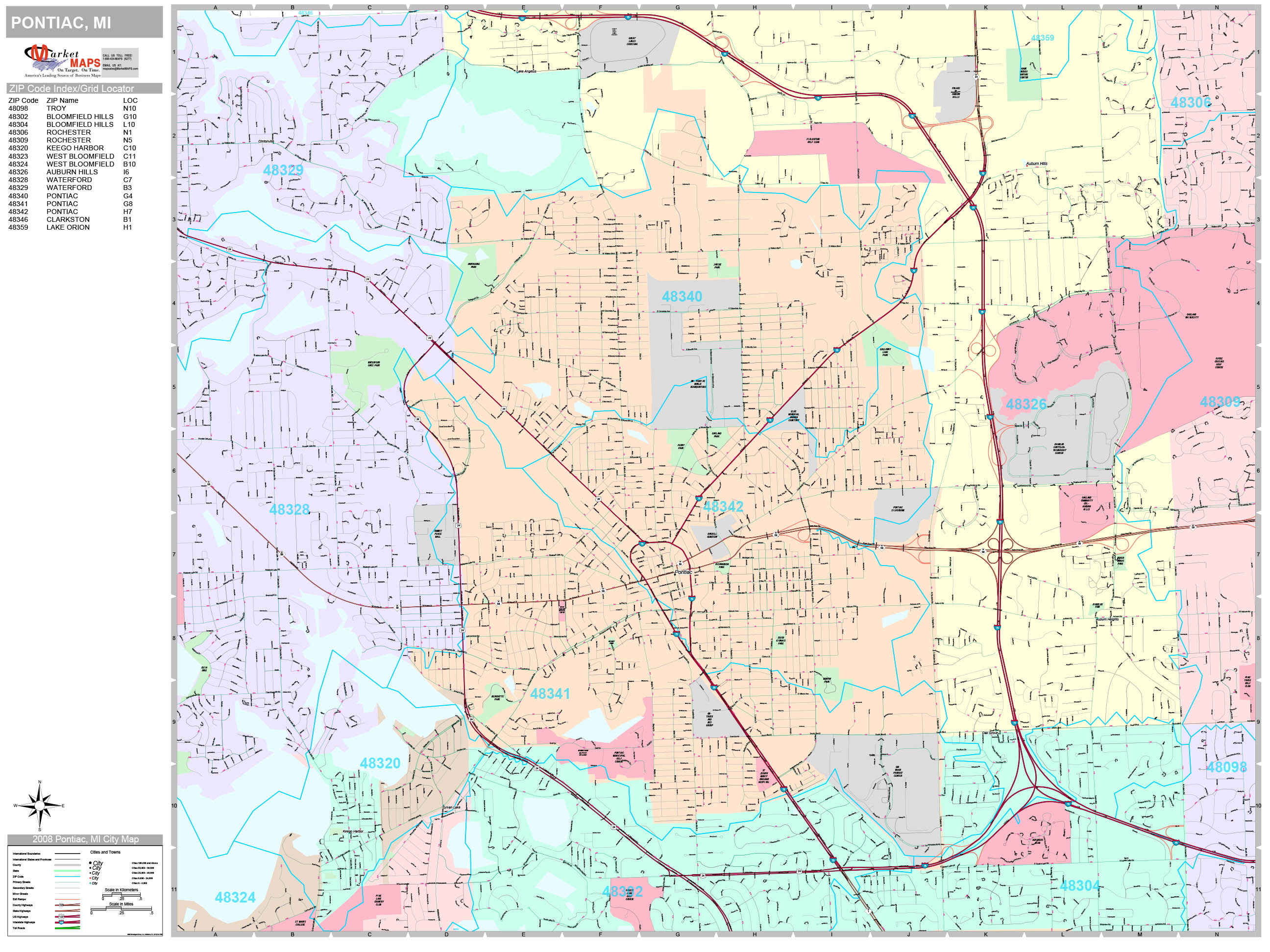

Which have good USDA financing, along with the borrower, the home must also see the requirements. Brand new debtor need completely file their capability to pay whilst not surpassing 115 per cent of your own average income into area. Also the borrower certificates, the house or property have to be located in an area that’s designated since the rural by USDA. Brand new outlying designation was recognized by area code. All of the Claims have outlying components appointed because of the USDA. In a few Says, new USDA keeps also appointed whole counties just like the rural and this all the home where condition manage be eligible for good USDA financing.

As the name means, a USDA financing was given of the All of us Company away from Agriculture. Yet not, you don’t have to own a great cow to take advantageous asset of this great chance. Due to the fact intent of program is actually for the benefit of outlying elements, many buyers try shocked to determine just how many romantic-within the suburban areas be considered.

A beneficial USDA loan is fantastic for people who happen to be trying to cash-during the for the cheap pricing on the outskirts regarding significant towns.

USDA fund was to have three decades having the lowest repaired speed. The most attractive ability regarding a beneficial USDA financing is the fact no down-payment becomes necessary. In reality, and an excellent Virtual assistant mortgage, a good USDA loan ‘s the just remaining completely financing solution nonetheless being used throughout the housing industry now. To find out more about any of it useful system, label 877-432-5626 .

The first step of process will be to get in touch with FedHome Mortgage Centers and you may consult with an authorities Financial Professional of the contacting 877-432-5626 . Your loan administrator will ensure that you will get started out into the proper foot. Receive the most out of your residence search experience, it is vital to end up being prequalified. Your loan manager will assist you to get a hold of just how much household you really can afford, making it possible to discover any choice and working closely along with you as you restrict your alternatives.

If you’re trying to find examining no matter if good USDA loan suits you, begin by calling 877-432-5626 .

Do you know the USDA Mortgage Conditions?

- The property must be situated in an area that’s designated just like the rural because of the USDA (the FedHome Financing Locations Loan Officer discover out in the event the a good house is eligible)

- System exists for purchase transaction merely (no investment functions otherwise 2nd home)

- Readily available for step one st Big date Consumer or Repeat Client (Customer do not own other home in the duration of pick)

- Entire cost (along with upfront MI) is funded (100% investment, zero downpayment needed)

- The minimum credit score having USDA recognition is 620. The latest debtor must have a reasonably good credit background which have restricted thirty day later costs over the past 1 year. The financial institution need dictate repayment feasibility, using percentages off installment (gross) money to help you PITI in order to full loved ones loans.

- Customer income is bound so you’re able to a maximum of 115% of one’s area’s average money (contact an effective FedHome Financing Locations regulators mortgage pro to own facts so you’re able to discover income restrictions for your city)

- W2 income or notice-working is alright (earnings and you can a position have to be fully recorded)

- Present from Settlement costs was greeting

- Provider or financial can be lead doing 2.75% of transformation rate into the settlement costs

Start-off

To learn more in the USDA casing finance or to submit an application for sign up for an excellent USDA mortgage online; phone call 877-432-5626 today otherwise finish the means more than .