Connecting Finance FAQ

If you find yourself struggling to fork out after the phrase, extremely loan providers often think extending the latest arrangement whenever you can be sure that your get-off method would be spending in the near future. not, they could struck your with hefty charge and you may costs for increasing the definition of.

Whether the financial kicks off repossession procedures when a debtor cannot accept up is at their discernment. If they don’t believe a leave is within attention, they might do that right way.

There might be situations where a connection will likely be refinanced on the conclusion the term, value and you may financing so you can really worth providing, however, expect higher scrutiny inside the get off if it is currently unsuccessful to spend just after.

Can i score a bridging loan in the event the I am unemployed?

It is theoretically you are able to to get connecting mortgage finance without individual money on antique feel given that every application is analyzed to the a beneficial case-by-circumstances base.

But not, just be sure to demonstrate that you has actually a leave means that pay out sufficient to pay-off the borrowed funds. Additionally, really managed loan providers usually insist on the fresh new debtor which have private money in the event your exit technique is an excellent remortgage, so if you’re by using the finance to purchase a home you’re going to upgrade, the fresh underwriters would want to understand how the newest work are getting becoming funded.

Are there connecting fund for more than 70s?

Definitely! Although some connecting company enjoys upper decades restrictions (usually 80 and up) the great majority was flexible sufficient to lend no restrict ages restrictions, so long as brand new borrower has evidenced a robust exit approach.

What records carry out Now i need to have a connection application for the loan?

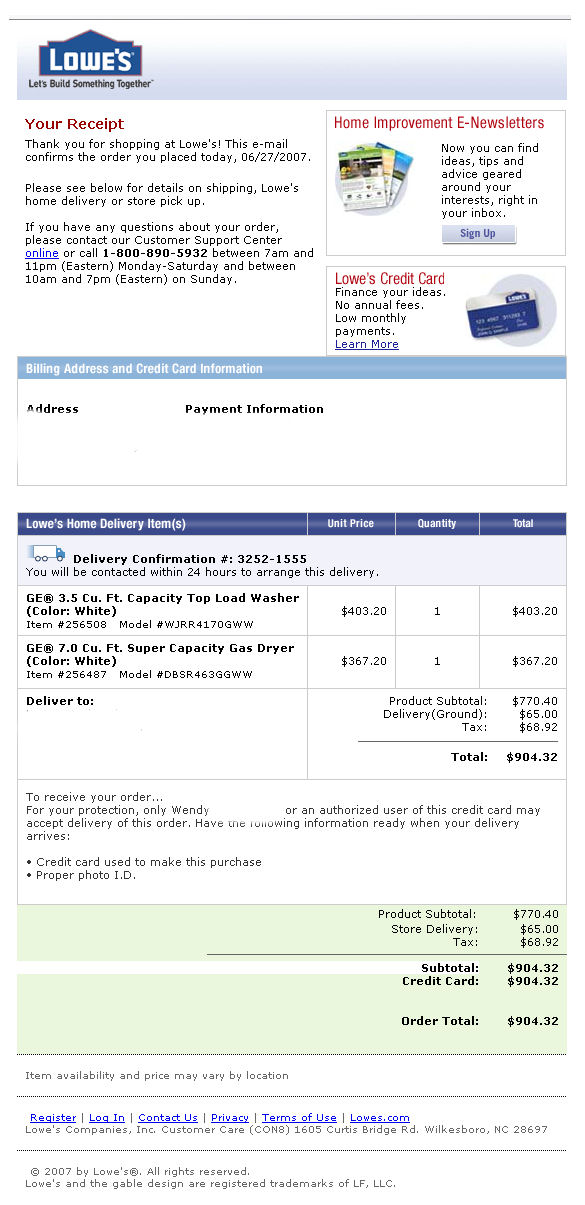

Just before rubberized stamping the link mortgage deal to help you finalise the latest contract, the latest bridging bank will need you to evidence the next towards related records…

- A beneficial valuation report:This won’t constantly need to be used ahead as most lenders will get her committee regarding surveyors take it aside. A fraction, not, you’ll demand that you feet the brand new valuation expenses yourself. When the several safety assets/house is being developed, you may have https://paydayloancolorado.net/sedalia/ to pay the additional valuation costs.

- Proof ID:Proof address (and you will residency, if the applicable) may also be questioned. Driver’s license, passport etc, are generally approved for it.

- Evidence of get off means:This might be practical having a connecting money application. When your plan will be to remortgage, following a deal theoretically usually suffice. Men and women having fun with non-basic get-off tips such as for instance investments or inheritance to settle brand new debt may be expected to provide evidence the loans are typing their bank account within a flat go out-figure.

- A business plan:If there’s a professional ability towards the assets you’re expenses inside, the brand new underwriters could possibly get demand a corporate propose to determine the stability.

- Evidence of your own experience in possessions:This can only be expected should your plan is to try to make a home. They ine their background on the market, especially if its a complicated innovation.

- Proof of money:Certain lenders often demand a beneficial diminutive particular income facts (lender comments etcetera), but it isn’t really needed just like the leave was regarding greater pros.

What will cost you and charges will there be on top of the interest?

- Arrangement fees:Usually a share of financing (around dos% was standard but can only be step 1% if the loan is very large).

- Valuation charges: Valuation need to be accomplished to your safeguards property/resource. Particular loan providers usually deal with this on your behalf, but others could possibly get predict you to base the balance, particularly when multiple safety is being put up. The purchase price are different in accordance with the property/asset’s worthy of, the type of valuation and also the area.