To purchase a property is a big economic choice that frequently relates to hundreds of thousands of bucks. Most people wouldn’t be able to afford homeownership without the help of mortgage brokers. Because of the funding house instructions through mortgages, lenders pave how for all of us away from all of the areas of life to locate its dreams of owning a home.

Financial people could offer numerous lenders, out of traditional repaired-rates mortgage loans so you’re able to bodies-backed fund, in order to meet the requirements of homebuyers with assorted economic affairs. An educated lenders can get work with borrowers to obtain the right loan unit to match their issues, also anyone who has subpar credit scores or abnormal income streams.

It can be enticing to decide on the borrowed funds company providing a decreased rates of interest, but finding the best home loan company for every single state demands much a lot more search than thinking about rates alone. Of the examining the alternatives from every you’ll direction, consumers is glean a more complete comprehension of what for every business brings loan places Strasburg to your table and you can those tend to has got the consolidation from professionals you to matter very due to their brand of factors.

- Best Full:PNC

- RUNNER-UP:Caliber Lenders

- Better On the web Sense:Secured Speed

- Top Software Processes:Skyrocket Financial

- Best Deals:SoFi

- Best for Virtual assistant Loans:Pros Joined

- Think about:Better

Financial organizations can differ notably-perhaps the most useful mortgage lenders can offer different types of fund and you may financing terms for customers to adopt. Prices factors, as well as mortgage pricing and you can annual commission costs (APR), may go from lender so you’re able to financial. Simultaneously, for every single team can get its own qualifications conditions one prospective borrowers need certainly to see to be eligible for a loan. Experiential situations, such as for example software procedure, closure timelines, and underwriting procedure, could all be additional with regards to the financial.

Eligibility Criteria

When you’re certain financial products has actually consistent baseline conditions one to individuals you want to meet to meet the requirements-FHA money, as an instance-lenders will additionally manage their unique qualifications standards to possess borrowers. Such standards have been in destination to eliminate economic exposure on the financial and reduce the probability of home financing default.

Eligibility criteria commonly composed and will likely be computed on a case-by-case foundation, many prominent activities are the size of the newest deposit, new borrower’s personal debt-to-earnings (DTI) ratio, its credit rating, their month-to-month income, or other monetary considerations. These types of eligibility standards know very well what categories of home loans a borrower qualifies to possess, the dimensions of the borrowed funds they’re able to score, together with interest rate linked to the financing. While the for each and every bank has its own standards, home buyers could possibly get be eligible for certain financing terminology which have you to mortgage company, however some other.

Software Procedure

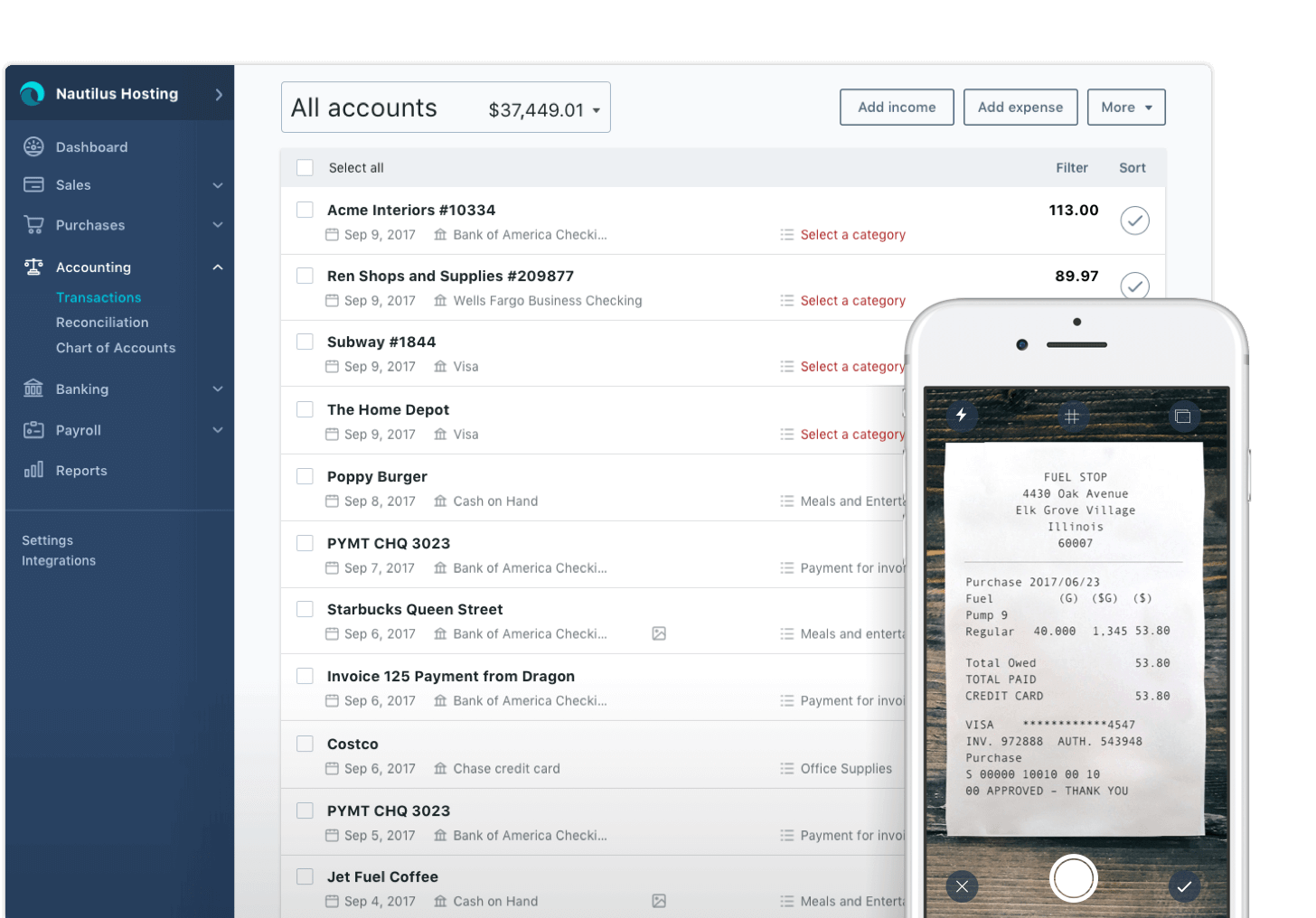

Applying for a mortgage can seem to be overwhelming having first-time homebuyers and you will experienced home owners the exact same-both considering the level of files necessary in addition to top out-of scrutiny involved. Certain loan providers will try to make the software procedure more comfortable for borrowers by permitting them to apply online otherwise compliment of a cellular application, entry digital duplicates out-of required records and you will signing files digitally in place of previously appointment one on one which have a loan manager. While doing so, certain homebuyers may want to speak to a loan administrator in person-or at least consult him or her over the phone-whenever obtaining a home loan, as well as may prefer to come across a home loan company that can fulfill those people needs.

Several other basis to take on is the secure-in period on mortgage price. When home financing is approved, individuals have the choice to help you lock in their attention rate it cannot alter anywhere between financing recognition and you will closing. Financial pricing is change considerably of day to day, and/or from hr to help you hr, so the ability to pounce into the reasonable costs in advance of they potentially improve can be very enticing. Lenders could possibly get secure prices for different intervals, although Individual Monetary Security Bureau notes you to 29, forty-five, and you may sixty-big date rate secure episodes are.